What to consider when moving home

November 25, 2022

Plans submitted for Birmingham build-to-rent project

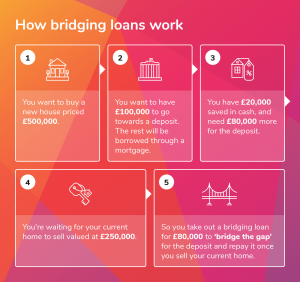

November 28, 2022This type of loan is used when money needs to be borrowed over a short period of time. Also known as a bridge loan, it is usually taken out to ‘bridge the gap’ while a person or company waits to secure a permanent financing option.

Table of Contents

ToggleWhen might such a loan be used?

Bridge loans are commonly used in property transactions. For example, a bridge loan may be used when someone wants to buy a new home but has not yet sold their current property. It may also be used when property is bought at an auction and money is needed straightaway to fund the purchase, but your current property is not yet sold. It may equally be useful in a situation where you are buying a new home but the buyer for your home pulls out. The take up of this kind of loan has grown dramatically in the months since the Bank of England base rate rise, with figures showing an increase of nearly 50% since the end of 2021..

How does a bridging loan work?

Bridge loans are a fairly simple and common type of short-term loan and are usually secured against a property. A charge is placed on your property which outlines who will be paid first if you default on repayments. A first charge bridge loan is the main loan on a property and takes precedence, while a second charge bridge loan is secured against a property which already has a loan or mortgage outstanding. If you default on a second charge loan and the property is sold off, your mortgage would be paid first.

Lenders will ask to see clear evidence and proof of a repayment plan for the loan, including evidence of a property purchase or sale.

Repayment deadlines depend on whether your bridge loan is open or closed. An open bridge loan has no fixed date for repayment, but it is normally expected that you will pay it off within a year. Closed bridge loans have a fixed repayment date and are most commonly taken out while waiting for a property transaction to complete.

How much can I borrow in a bridge loan and how much does it cost?

A loan to value ratio of up to 75% of your property is typical with most bridge loans. These loans can be quite expensive, however, with fees of as much as 1.5% per month. The APR on a bridging loan is generally far higher than most mortgages.

You are also recommended to appoint a bridging loan solicitor to help complete paperwork. The process usually takes around two to four weeks. The cost of securing a bridge loan will vary but legal, administration, arrangement and valuation fees all need to be considered.

What are the pros and cons of a bridge loan?

A bridge loan is a great way to secure money quickly and can be useful in property purchases, helping you to swoop on your dream home or keep your place in a chain. Bridge loan lenders often tend to offer flexible repayment plans. However, these loans do come with high interest rates, there are various fees to pay and with your property as security, your home could ultimately be at risk if you do not meet repayments.