How Do You Know If Your License Is Suspended in Alabama

October 20, 2025Why a power of attorney is not just for the elderly

October 21, 2025How Do I Know If Alabama Received My Tax Return?

Filing your state income tax return can come with some anxiety, especially if you’re waiting on a refund or want to be sure Alabama received what you sent. In this article, we’ll walk you through how to verify whether Alabama’s Department of Revenue (ADOR) has your return, what the different status messages mean, and what to do if something seems amiss.

Table of Contents

ToggleUnderstanding Alabama’s Tax Return Process

Before diving into status checks, it helps to know how returns flow through the system in Alabama.

E-file vs. Paper Returns

- When you e-file, your return is submitted electronically and integrated into ADOR’s system faster.

- Paper (mailed) returns must be manually entered and can take longer to register in ADOR’s databases.

Because of manual processing, mailed returns often show up in status tools later than e-filed ones. That’s normal.

Processing Timeframes

After ADOR receives your return, it enters a pipeline of validation, error checking, possible identity verification, and then refund or assessment. For e-filed returns, you’re generally eligible to start checking status after 24 to 48 business hours. For mailed returns, a good rule is to wait 6 to 8 weeks before expecting the return to be scanned and entered.

How to Check Whether Alabama Received Your Return

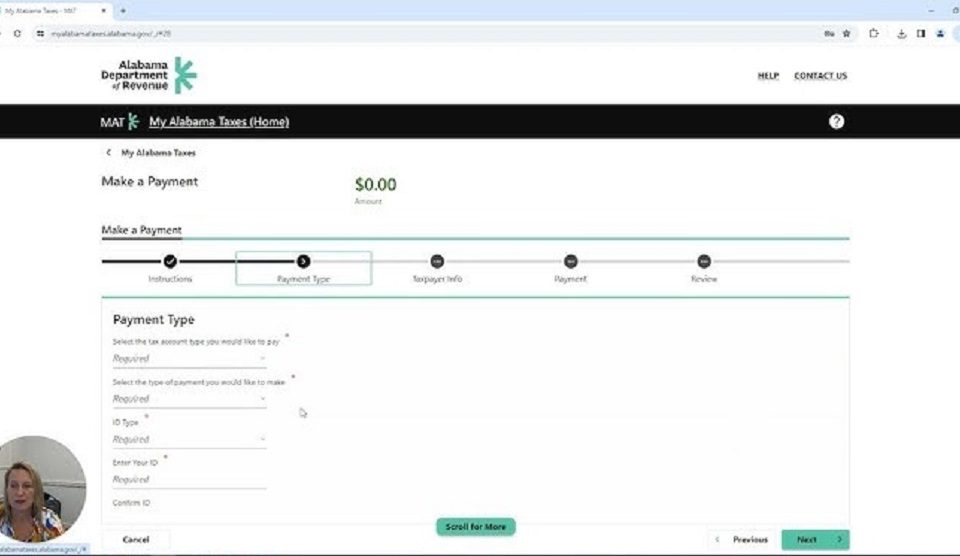

Using My Alabama Taxes (MAT) Portal

The fastest, most reliable way is via the **My Alabama Taxes (MAT)** website.

Here’s what to do:

- Go to myalabamataxes.alabama.gov.

- If you have a MAT account, log in; else you may use non-registered access for refund status.

- Navigate to “Where’s My Refund” or “Check Refund Status” for individual income tax.

- Enter required identifying data (e.g. Social Security Number, filing status, refund amount or date). The portal will respond with a status message.

The status may indicate “Received,” “Processing,” “Approved,” or “Refund Sent,” among others.

Calling ADOR’s Refund Hotline or Status Line

If you prefer phone assistance or don’t have reliable online access, ADOR provides phone lines for refund inquiries.

When calling, have your return or refund details handy (SSN, filing status, amount). The line will ask you to enter these to retrieve status updates.

Wait Time Guidelines & What “No Record” Means

If you’ve e-filed, allow **24 to 48 business hours** before checking for registration in ADOR’s system. If there’s no record after that, double-check whether your submission was accepted or rejected.

Common Delays or Reasons a Return Isn’t Shown

Even when you’ve filed properly, the system might not show your return immediately. Some common causes:

- Errors or missing info: Mistyped SSN, wrong names, missing signatures. ADOR may hold processing until issues are clarified.

- Identity verification or review holds: ADOR sometimes flags returns for identity confirmation or additional review.

- Mailed-return backlog: Paper returns have to be scanned and entered manually—delays in mailing or scanning can push things back.

- Refund offsets: If you owe state debts (child support, unpaid state tax, or court fines), ADOR may offset your refund. {index=10}

If your return is flagged for review, ADOR will typically send you a letter requesting further documentation or verification. {index=11}

What if ADOR Doesn’t Show Your Return?

If your return or refund status is “not found” after the expected waiting period, consider these steps:

- Confirm you entered correct identifying information in the portal or phone system.

- Check your e-file service or mail tracking to see if your return was rejected or lost.

- If it was mailed, consider whether you need to refile (either electronically or via mail) after confirming no duplicate entry.

- If necessary, contact ADOR by mail, email, or phone asking for assistance. Include your SSN, filing year, and copies of your return. You can reach ADOR via their contact center or local taxpayer service offices.

Don’t immediately refiling without verifying—duplicate filings can complicate processing.

Typical Processing & Refund Timelines

| Filing Method | Expected Time until Return Appears in System | Estimated Refund Timeline |

|---|---|---|

| E-file | 24–48 business hours [oaicite:13]{index=13} | 8–10 weeks on average |

| Paper / Mailed | 6–8 weeks | 8–12 weeks or more |

Note: These timelines are general estimates. Complex returns, identity verification holds, or backlog periods (like tax season) can extend processing.

Tips to Help Ensure Your Return Is Received

- Double-check all personal info (SSN, names, address) before submission.

- If mailing, use tracked or certified mail so you have proof of delivery.

- Keep electronic acknowledgment or confirmation from your e-file provider.

- Monitor your email, mail, and MAT portal for any notices or identity verification requests.

- If ADOR asks for additional documentation, respond promptly to avoid extra delay.

Related Topic : Time Difference Between Alabama and Texas?

Conclusion

It’s natural to wonder whether Alabama received your tax return, especially when waiting on a refund. The My Alabama Taxes (MAT) portal remains the best starting point to check status, with phone support as a backup. Be aware that e-filed returns usually appear sooner, while mailed returns take more time. If your return doesn’t show up after waiting the standard time, carefully review all your information, and contact ADOR rather than immediately refiling. With patience and accurate info, you’ll be able to confirm whether Alabama has your return and where it is in the process.